The insurance industry is increasingly confronted with changing market needs, rising customer expectations, and high cost pressure. To master these challenges, insurance companies need to digitalize. Non-physical products, such as insurances, are particularly well suited to digital solutions. As an example, processes can be automated or claims can be processed digitally and therefore faster. However, the heart of the insurance business – the registration, forecasting, and reduction of risks – can also be improved and automated through the use of digital solutions. Find out more about how the digitalization trend in insurance is reflected in figures, what potential lies in the digital transformation, and what digitalization challenges insurance companies are facing.

The insurance industry is increasingly confronted with changing market needs, rising customer expectations, and high cost pressure. To master these challenges, insurance companies need to digitalize. Non-physical products, such as insurances, are particularly well suited to digital solutions. As an example, processes can be automated or claims can be processed digitally and therefore faster. However, the heart of the insurance business – the registration, forecasting, and reduction of risks – can also be improved and automated through the use of digital solutions. Find out more about how the digitalization trend in insurance is reflected in figures, what potential lies in the digital transformation, and what digitalization challenges insurance companies are facing.

The trend towards digitalization in the insurance industry in figures

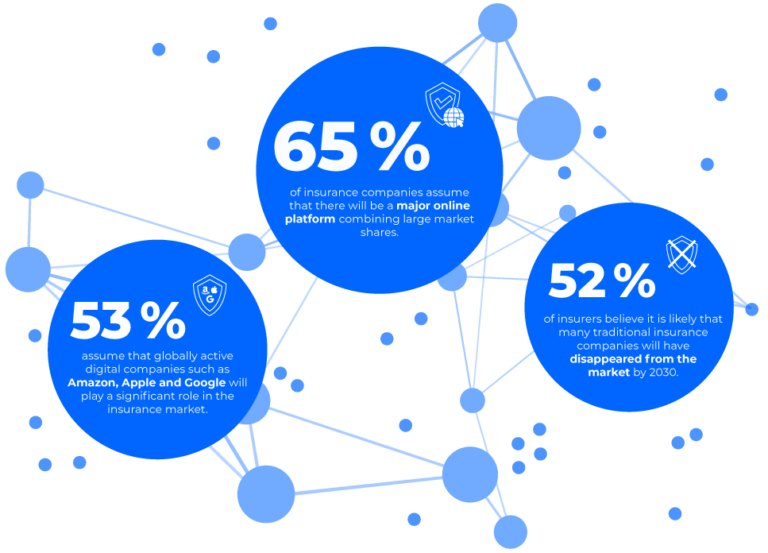

It is becoming increasingly clear to insurance companies that the transition to digital solutions is necessary to remain relevant in the market. A survey by Liferay shows that more than half of insurance companies attach great importance to digital change and its impact.

65% der Versicherungsunternehmen gehen davon aus, dass es eine starke Online-Plattform geben wird, die große Marktanteile auf sich vereint.

53% vermuten, dass global tätige digitale Unternehmen wie Amazon, Apple oder Google auf dem Versicherungsmarkt eine bedeutende Rolle spielen werden.

52% der Versicherer halten es für wahrscheinlich, dass zahlreiche traditionelle Versicherungsunternehmen bis 2030 vom Markt verschwunden sein werden.

The potential of digitalization for insurance companies

Digital and automated processes create value for businesses by increasing efficiency and reducing costs. In the context of insurance companies, three areas in particular have emerged as potential areas for value creation through digitalized processes.

Data Analytics

Insurers already have a lot of customer data, environmental data, and data from cooperation partners. Efficient evaluation and presentation are important to make the data usable. A comprehensive target group analysis and segmentation enables a better understanding of customers and thus also the creation of individual offers. Further potential lies in the creation of forecasts, the improvement of strategic decisions and the automation of business processes. Over 85% of the insurers surveyed for the Insight expert panel stated that they were already active in the field of data analytics. Data analytics is most established in risk management at insurance companies.

Customer Journey

Customers' expectations of insurance companies have increased. They expect constant access across all channels, individual service offerings, and simple, digital processing of financial services. In addition, demands for a consistently positive user experience of products and services have increased. For this reason, insurance companies are placing particular importance on simplicity, flexibility, and a strong focus on the customer. In the context of customer centered thinking, Customer Journey Analytics techniques have proven effective to visualize and understand the customer experience in all phases and to identify and eliminate weak points. This enables insurers to fulfill their value proposition across the various channels and stand out in a highly competitive market.

Omnichannel

The number of different channels through which users interact with an insurance company is increasing. The sales channels of German insurance companies are becoming increasingly linked, as a study by Q_Perior has shown. The challenge for insurance companies is to set up this complex networked omnichannel of online and offline touchpoints in a way that promises a consistently positive user experience for customers and allows them to switch seamlessly between different insurance channels. Another trend is the implementation of voice assistants. Almost 50% of insurers state that they already use chatbots or voice assistants for lead generation, first-time consultations, explanations of terms and initial calculations.

The challenges of digitalization

Data-based analyses or an optimized omnichannel customer journey may sound promising, but the necessary level of digital maturity must be achieved first. Not all insurance companies have fully completed the digital transformation process. They face both industry-specific and company-specific obstacles.

- Competition and cost pressure

The financial pressure on insurers is increasing due to comparison portals and unpredictable claims expenses, among other aspects. New platform-based business models and additional competitors are entering the market and customers are becoming more price-sensitive. Insurers face significant cost pressures and competition. To remain competitive, cost and performance transparency on comparison platforms requires continuously adapting services. - Security risks

The increased risk situation in areas such as climate, politics and cybercrime requires proactive risk management, especially for insurance companies as a financial security network. Monitoring risks is a prerequisite for minimizing losses or preventing them from occurring in the first place. Cyber attacks in particular pose a major risk to consumer data. To reduce the dangers of cybercrime, insurance companies must strengthen global protection and resilience, early detection and defense against attacks, as well as the operational readiness and quality of countermeasures. - Restrained corporate growth

Added to this is the population’s vulnerability due to current crises and uncertainties, and demographic change. This creates challenges for insurance companiessuch as long-term financing, a shrinking number of potential new customers, and a problem with recruiting new talents due to a cultural change in the working environment. The shortage of skilled workers is also very noticeable in the insurance industry. Insurance companies cannot keep up with the increasing volume of expenses, which is hampering the growth of organizations. - Outdated isolated structures

Insurance companies offer complex products and services, and often still have outdated structures with isolated departments and separate systems. However, a seamless experience is not possible without integration between the different channels. In some cases, there is also a lack of agility and willingness to change. A digital transformation in the insurance industry is therefore associated with considerable investment in technology and infrastructure.

Process mining for insurance companies

In our LinkedIn Live Event we focus on the insurance industry. Our insurance expert, Sirko Schoeder, will discuss the current challenges and potential of digital initiatives, data analytics and process mining in insurance companies. Join us as our expert reports on best practices and added value through process mining in insurance companies.

LinkedIn Live | mpmX in Focus: Insurance Industry | Language: German

Find out more about the added value and possible use cases of process mining for insurance companies.

[1] https://www.liferay.com/de/web/l/digitalisierung-der-customer-journey-bei-versicherungen

[2]https://www.researchgate.net/publication/358917765_Digitalisierung_bei_Versicherungen

[3] https://www.consulting.de/hintergruende/themendossiers/unternehmensberatung-in-der-versicherungswirtschaft/versicherungswirtschaft-im-wandel-aktuelle-herausforderungen/

[4] https://www.is2.de/magazin/fachartikel/customer-journey-versicherung/

[5] https://www2.deloitte.com/de/de/pages/financial-services/articles/versicherungsausblick-2024.html

[6] https://www.q-perior.com/wp-content/uploads/2023/11/Q_PERIOR_HYBRID-SALES-INDEX-2023_Deutsche-Erstversicherer-im-Omnichannel-Benchmark.pdf#msdynttrid=VDmak6Fm_1IozPqPGwM08f5JTXvH5mjyPlvfx3x5ZHY

[7] https://de.easysend.io/blog/kartierung-der-customer-journeys-im-versicherungswesen-fuer-eine-bessere-kundenerfahrung

[8] https://link.springer.com/article/10.1007/s12297-022-00531-6