You are not alone in this

Shortage of skilled workers

Insurance companies cannot keep up with the increasing volume of expenses, which is hampering the growth of organizations.

Frustrated employees

Insurance employees are frustrated by recurring inefficiencies in claim processes.

Cost pressure

The financial pressure on insurers is increasing due to comparison portals and unpredictable claims expenses.

Intransparent processes

Customers lose their trust in an insurance company when they do not know the current status of their claim.

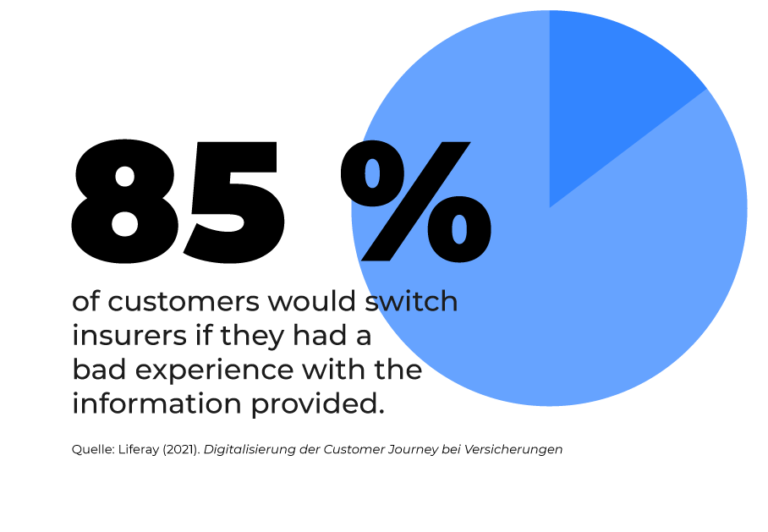

Disappointed customers

The customer experience suffers because claims are processed too slowly or because customers are not kept informed of the processing status.

Customer churn

Expectations for a positive service experience are higher than ever. Even short delays cause customers to churn.

How we help

Full transparency

With our Qlik-based Process Mining solution, we create transparency about claims processes and customer journeys. We show you exactly where optimization is needed. In this way, resources such as employees can be deployed more efficiently and trust-breaking moments within the customer experience can be identified and solved.

Improved

Combined Ratio

The combined ratio can be reliably controlled with process mining. How? We don't have claims costs under control, but we do control internal costs! We help you to save costs efficiently by constantly reducing administrative expenses, optimally estimating loss reserves and constantly checking the profitability of various insurance products.

Digital & automated processing

Repetitive, manual and time-consuming tasks in your insurance processes can be easily automated and orchestrated with mpmX – even across departments and systems. On the one hand, customers can be satisfied with the digital, fast and informed processing of their claims. On the other hand, insurance employees are relieved and can concentrate on handling special cases.

Download the whitepaper now

Use the full potential of Process Mining for your insurance company! Download our whitepaper and discover how mpmX can optimize your processes.

Your benefits with mpmX

Freedom of Deployment

On-premise or cloud – your choice! You maintain complete control over your data.

2 in 1: Analysis and Automation

Powerful process mining and execution component in one platform.

Short Time-to-Launch

We implement your project in the shortest possible time. We present the first results within 8 days.

Insurance Expertise

We support insurance companies from various sectors and know the challenges you face.

Process Mining for Claims Management

Claims management is the core process of any insurance company. In order to satisfy everyone involved in claims management, technology and empathy must be balanced. Process mining can be used to control the key parameters of claims processing in order to improve the process for everyone involved.

Optimized Claims

Management at BGV

With the help of mpmX Process Mining, BGV Badische Versicherungen has been able to continuously reduce its lead times so that claims can be processed more quickly. This has increased the efficiency of claims settlement, which benefits BGV's customers.

Daniel Dehm, Head of Business Intelligence

BGV Badische Versicherungen

"With mpmX we found a perfectly fitting solution for our BGV server landscape and infrastructure. The high performance with large data volumes was convincing. Furthermore, the flexible self-service analysis options allowed us to define to-be processes."

Download Case Study

BGV Badische Versicherungen

Read the case study to find out how BGV was able to analyze and sustainably optimize its claims processes with mpmX.

Understanding Customer Journeys with Process Mining

Customer journeys are complex. The number of different channels, systems and interfaces through which leads and insurance customers are generated or interact is constantly increasing. At the same time, the number of different touchpoints is also constantly growing.

Process Mining enables insurance companies to actively analyze and manage customer satisfaction. This enables them to identify and eliminate weak points in the customer journey.

The price war in the insurance industry is growing, as comparison portals such as CHECK24 tempt customers to quickly switch to cheaper insurance providers. WGV relies on a long-term and trusting customer relationship. Process Mining is the ideal tool for experiencing processes from the customer‘s perspective and thus optimizing every input channel. Process Mining shows the changes and supports ongoing agile improvement.

Case Study WGV

Read the case study to find out how WGV makes process structures transparent and makes data-driven decisions.

Understanding the customer

Many insurance companies want to work in a customer-centric way. Process Mining makes it possible to understand every phase of the customer relationship and to take exactly the right measures to strengthen the customer experience.

Overview of all touchpoints

With Process Mining, all possible touchpoints can be included in the analysis of customer processes. This makes it possible to determine where breaks or dissatisfaction occur.

Predict and utilize trends

When it comes to acquiring new customers, it is particularly important to use the right channels to pick up target groups where they are. Process Mining shows which channels have the greatest potential.

How to get started

Contact us and describe your current challenges and goals.

We will contact you within 3 days and clarify the technical requirements for an mpmX project with you.

Within 8 days, we will prepare a proof of value with your data and present you with the first results of your insurance processes.

More about Process Mining for insurance companies

Your Process. Your Potential.